Angela Colley — Building Blocks

In good times and in bad, we lean on debt. With the cost of living outpacing income growth, more and more people are relying on credit cards and loans to bridge the gap between paydays—and it’s starting to show. The total credit card debt held by U.S. consumers has hit $764 billion, according to a recent analysis from Nerd Wallet.

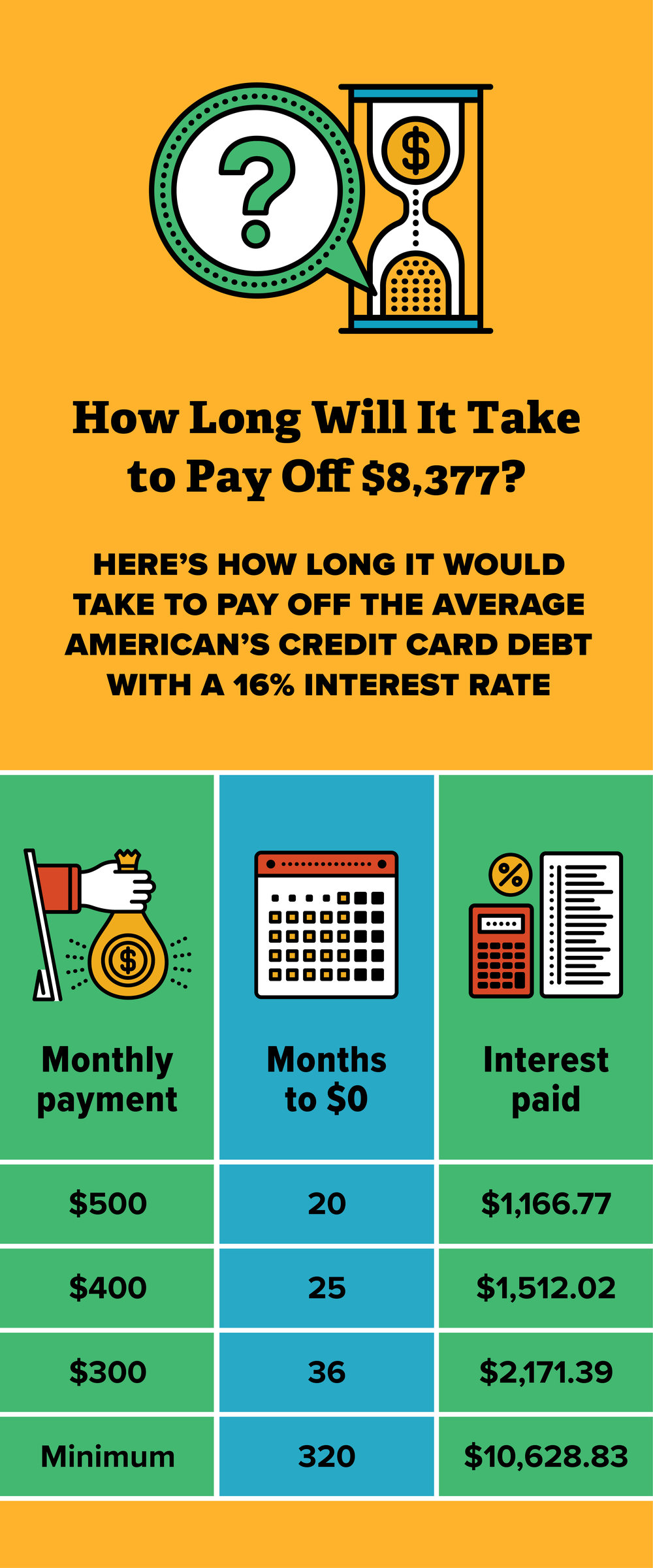

As of the first quarter of 2017, households carrying credit card debt were saddled with $8,038 on average, a 6 percent increase from the same time last year. On top of that, cardholders are being charged an average interest rate of 16 percent on their outstanding balances.

If you’re carrying credit card debt and making the minimum payments, you could be paying those down for years—tacking on more and more interest all the while.

While paying in cash, establishing an emergency fund, and setting up regular budget audits to keep your expenses down are all worthwhile, things happen—things that can set you back on your path to financial freedom. If you’ve had to finance a surprise purchase or are still reckoning with undisciplined spending habits from years past, you can still pay off that debt for good. And with a solid plan, you can pay it off sooner than you think.

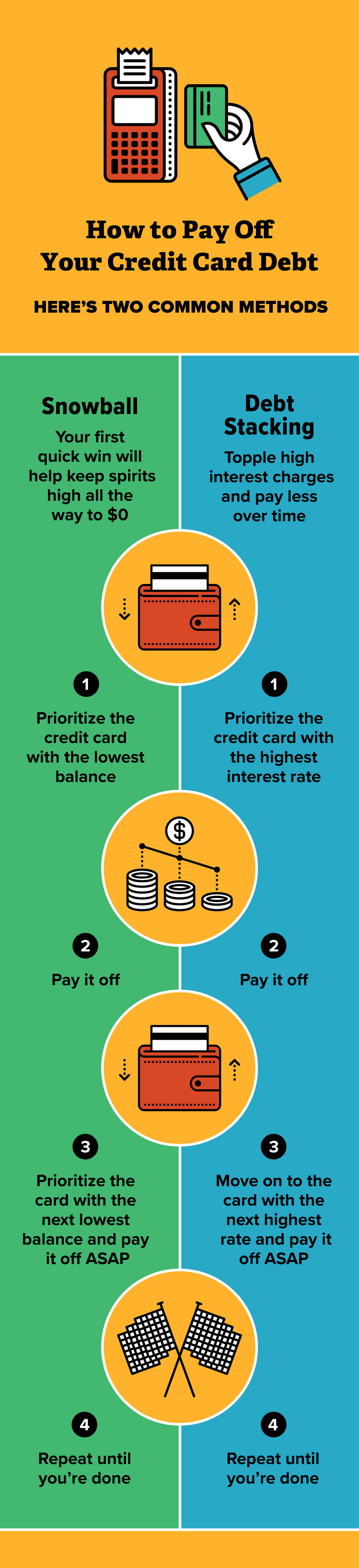

When it comes to tackling your credit card balances, there are two predominate schools of thought, the snowball method and the debt stacking method. Both have advantages and disadvantages, and one is likely better suited to your specific needs than the other.

Once you’ve picked a method, develop a solid plan to pay those balances down. Calculate how much you can devote to making payments each month. Make a list of everything you owe and pick a starting point, depending on whether you prefer the snowball or debt stacking approach. From there, stick with your plan, don’t beat yourself up if an emergency expense knocks you off course, and remember that with either method, slow and steady wins the race.